Published on

France’s inaugural issuance of a “European defence bond” to raise €1 billion for the country’s defence companies was massively oversubscribed, with two-thirds of investors coming from outside its borders.

The bonds, due to mature in five years, received strong support, with a final order book exceeding €3.8 billion — nearly four times the value on offer, France’s public sector investment bank (Bpirance) said in a statement.

In a sign of growing pan-European support for the initiative, 66% of allocations went to investors outside France, including 22% from the Nordic countries and 20% from Southern Europe. Investors in the Benelux area, DACH countries — Germany, Austria and Switzerland — as well as the UK and Ireland also took part.

“This ‘European Defence Bond’ initiative aims to bolster strategic autonomy and competitiveness within the defence industry. It marks an important milestone for Bpifrance and for the entire defence ecosystem in Europe,” Bpifrance CEO Nicolas Dufourcq said.

“We are committed to supporting innovative companies and enhancing Europe’s defence capabilities, with a particular focus on SMEs and mid-caps that play a crucial role in the sector’s value chain,” he added.

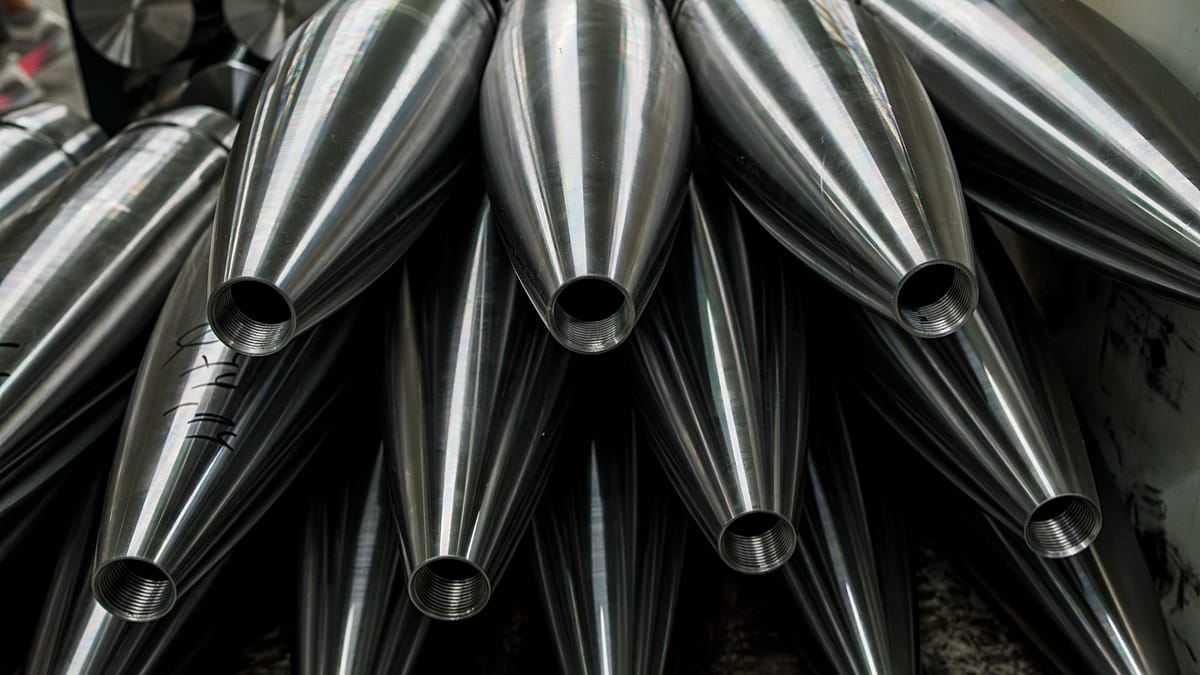

Proceeds from the issuance will be used to finance or refinance loans dedicated to defence sector players under Bpifrance’s Def’fi programme, which provides tailored financing for small and medium-sized enterprises supplying the defence sector, as well as support companies within France’s defence industrial and technological base.

The issuance comes as cash-strapped EU member states seek to rapidly and massively rearm amid the credible threat posed by Russia.

The battle over joint debt

The European Commission has put forward a plan it says can see up to €800 billion invested into defence by the end of the decade. But most of the cash is expected to come from member states’ own coffers via the activation of the national escape clause in the bloc’s Stability and Growth Pact.

The EU executive has so far allowed 16 countries to deviate from stringent fiscal rules in order to pour money into defence.

However, France, whose debt already far exceeds the EU’s mandated maximum threshold, has been pushing for more innovative financing options, including so-called defence bonds.

This is vehemently rejected by some of the so-called frugal countries, which object to joint debt and argue the experience of the post-COVID pandemic recovery plan — for which repayments ballooned due to a sharp increase in inflation and interest rates — shows joint debt is not sustainable.

Brussels has also put forward proposals to slash red tape for defence companies, including measures to improve access to finance.

At cause are the EU’s environmental, social, and governance (ESG) standards which rank companies on the efforts they make towards becoming more sustainable and which investors and other companies keep a close eye on.

Under the EU’s taxonomy, which provides a bloc-wide classification system for sustainable activities with the aim of directing investments towards activities most needed for the green transition, defence is seen as “dirty” or unsustainable.

That means that securing a loan, or services including energy provision or even transport, can become difficult for any company that works in defence or supplies companies in the sector and can result in small and medium-sized enterprises (SMEs) being penalised.

The European Defence Bond is just one of the new products Bpifrance has developed to secure finance for the sector.

Last month, it launched a new fund open to private investors with a minimum deposit of €500 to support unlisted defence start-ups, SMEs and mid-cap companies. The fund target size is €450 million.