As debate grows over National’s plan to lift KiwiSaver contributions to 12%, finance professor Aaron Gilbert warns the policy risks worsening structural inequities already baked into the scheme — and why reform, not tinkering, is urgently needed.

On the face of it, the National Party’s proposal to lift KiwiSaver contributions to 12% over the next six years sounds reasonable.

There’s broad agreement that contributions are too low, and even the planned increase to 4% in 2028 won’t get most people close to the widely cited “70% of retirement income” benchmark.

So yes, employee and employer contributions do need to rise. And the argument that lifting contributions to 12% will align New Zealand with Australia makes good sense, too.

But the timing could not be worse. Nearly 26% of New Zealanders say they’re struggling to get by financially. Higher living costs, inflation outpacing incomes and muted wage growth (to put it charitably) have left households stretched.

Asking people to find extra money to lock away in KiwiSaver right now risks pushing them in the opposite direction – deciding KiwiSaver is optional, not essential.

And this is happening at a time when disengagement is already a problem. In 2025, we saw the first ever drop in the number of active KiwiSaver contributors. A full 40.6% of members aren’t contributing.

Even excluding the 400,000 members aged 65 or over, we’re still left with just over one million New Zealanders who are putting nothing in.

Add more than 80,000 savings suspensions and over 40,000 financial-hardship withdrawals last year, and the pattern is clear: those who need KiwiSaver the most are the ones being priced out of it.

So while the latest suggestions look positive at first glance, they once again skate past the fundamental issue of KiwiSaver having structural inequities baked into it. Until those are addressed, the retirement security the scheme was designed to provide will remain elusive.

Two structural features of KiwiSaver are poised to widen these inequities further.

You can lose more pay under a ‘total remuneration’ package

For most employees, the employer’s 3% contribution is on top of their salary.

But some people are paid differently: under what is called “total remuneration”, the employer’s contribution is part of a single fixed pay package.

This means the employee effectively pays both their own contribution and the employer’s – but relies on the employer specifically adding the contribution on top of the base salary and ensuring this doesn’t erode over time in dollar terms. This loophole has been flagged by KiwiSaver provider Kōura and the Retirement Commissioner.

Under current settings, someone earning $40,000 and contributing 3% loses $1200 in take-home pay.

With a total remuneration package, that jumps to $2400. If contributions rise to 12% without closing this loophole, that would become a $4800 haircut.

At that point, people will understandably question whether locking up 12% of their income for decades is worth it.

How widespread is the problem? No one knows for sure, but the Retirement Commission estimates almost half of employers have at least some staff on total remuneration, and a quarter have all staff on it. That could easily affect hundreds of thousands of workers.

The all-or-nothing contribution rule

KiwiSaver’s structure means that if you can’t afford to contribute – even temporarily – you don’t just miss out on your own 3%. You also lose the employer contribution and the government tax credit.

This creates two predictable and unfair outcomes:

- Lower-income households end up subsidising the government’s matched-contribution incentives through their taxes, with those benefits flowing disproportionately to higher-income earners

- Employers contribute less toward retirement savings for low-wage staff, simply because those workers can’t afford the upfront 3% – while higher-income workers enjoy both employer support and the ability to save independently.

In effect, we get a retirement savings system that helps those who need it least, while leaving the most vulnerable dependent on taxpayers later in life. That’s corporate welfare in slow motion.

Time for a full review of KiwiSaver

If alignment with Australia is the goal, New Zealand can’t cherry-pick the parts that look good politically. Australia is far stricter on total remuneration, and employers must contribute regardless of what employees do.

To be serious about reducing the brain drain and building a genuinely comparable system, the focus needs to be on all the differences – not just the headline contribution rate.

KiwiSaver has many good features. But it is increasingly set up to reward the people who were already on track for a secure retirement and penalise those who aren’t.

What it needs now is a proper, holistic review focused on equity and long-term stability. This should also look at fixing the gender gap in contributions due to income disparities, and the potential to make KiwiSaver compulsory – as superannuation is in Australia.

It is worth noting that fixing total remuneration packages and tightening employer contribution rules would make it easier to make KiwiSaver compulsory, mitigating concerns about whether low-income households could afford it.

Crucially, once the system is fixed, it needs stability. As Simon Power from Fisher Funds has pointed out, KiwiSaver works best when people can trust it won’t be changed so often.

If we want KiwiSaver to deliver on its actual purpose – supporting New Zealanders in retirement – then it’s time for thoughtful reform and an end to piecemeal tinkering.

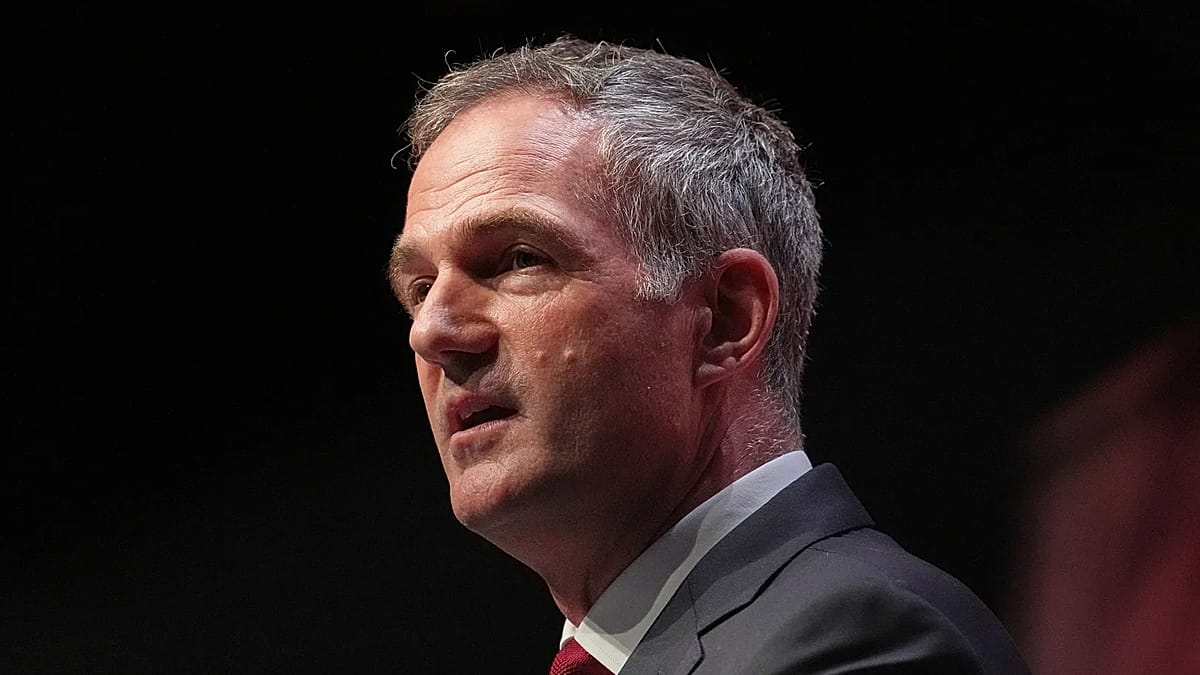

Author Aaron Gilbert is a Professor of Finance at Auckland University of Technology

This article was republished from The Conversation under a Creative Commons licence.

The morning’s headlines in 90 seconds, including a second blaze at a Waiuku business park, more arrests over the Louvre heist, and how to avoid Black Friday regret. (Source: 1News)