The Reserve Bank of New Zealand has cut the official cash rate to its lowest level in three years to support economic recovery.

The benchmark interest rate dropped by 25 basis points to 2.25% this afternoon – the lowest since June 2022.

The central bank’s rate setting committee says the economic recovery is patchy and slow but inflation was expected to ease next year, allowing another reduction.

The cut was expected and brings the OCR to a three-year low. It was another split decision, which may be the last in the current cycle.

The central bank’s monetary policy committee (MPC) voted five to one for a smaller cut after October’s outsized 50 point reduction.

But it noted it did not want a delay in getting inflation back into the target band mid-point, and there was “low tolerance” in the achieving that.

“The committee noted that a reduction in the OCR would help to underpin consumer and business confidence and lean against the risk that the economy recovers more slowly than needed to meet the inflation objective.”

It said inflation – which is at the top of the RBNZ’s 1-3% target band – was expected to ease back given the spare capacity in the economy.

“Risks to the inflation outlook are balanced. Greater caution on the part of households and businesses could slow the pace of New Zealand’s economic recovery.

“Alternatively, the recovery could be faster and stronger than expected if domestic demand proves more responsive to lower interest rates. “

The next decision is due on February 18, when new governor Anna Breman will have taken up her role.

Door ajar for more cuts

Most economists expect the Reserve Bank has now finished its rate-cutting, which has seen the OCR slashed by more than 3 percentage points from 5.5% in just over a year, but generally agreed that the bank would leave itself flexibility if the economy continues to struggle.

The MPC said it looked hard between a cut now and staying on hold.

“Leaving the OCR unchanged at this meeting would provide the optionality to lower the OCR in the future if required.”

But it did not close the door to further easing.

“Future moves in the OCR will depend on how the outlook for medium-term inflation and the economy evolves.”

ASB chief economist Nick Tuffley said the door for further easing remained open – but not as wide as many would have expected.

“The RBNZ’s OCR track reaches a low of 2.20 percent – hinting at a sniff of further easing, but not as 50:50 as markets had anticipated,” he said in a note.

Tuffley said eyes were on the central bank’s forward thinking.

“On that front, the RBNZ was a bit more cautious than generally expected. The RBNZ will cut again, if needed, but mainly if the economy looks set to underperform its latest forecasts.”

Tuffley said economic forecasts looked reasonable for the central bank, and early signs of economic recovery were showing in job market indicators.

“Our base case is the RBNZ will keep the OCR on hold now at 2.25 percent, and watch closely for various lagged stimuli to work through with more effect. If the economic recovery underwhelms, then the RBNZ could cut again. But, barring nasty surprises, the RBNZ looks on hold now.”

Co-Op bank responds

Just minutes after the OCR cut was announced, the Co-Operative Bank said it was dropping its floating home loan rate by 31 basis points, more than the Reserve Bank’s reduction, to 4.99%.

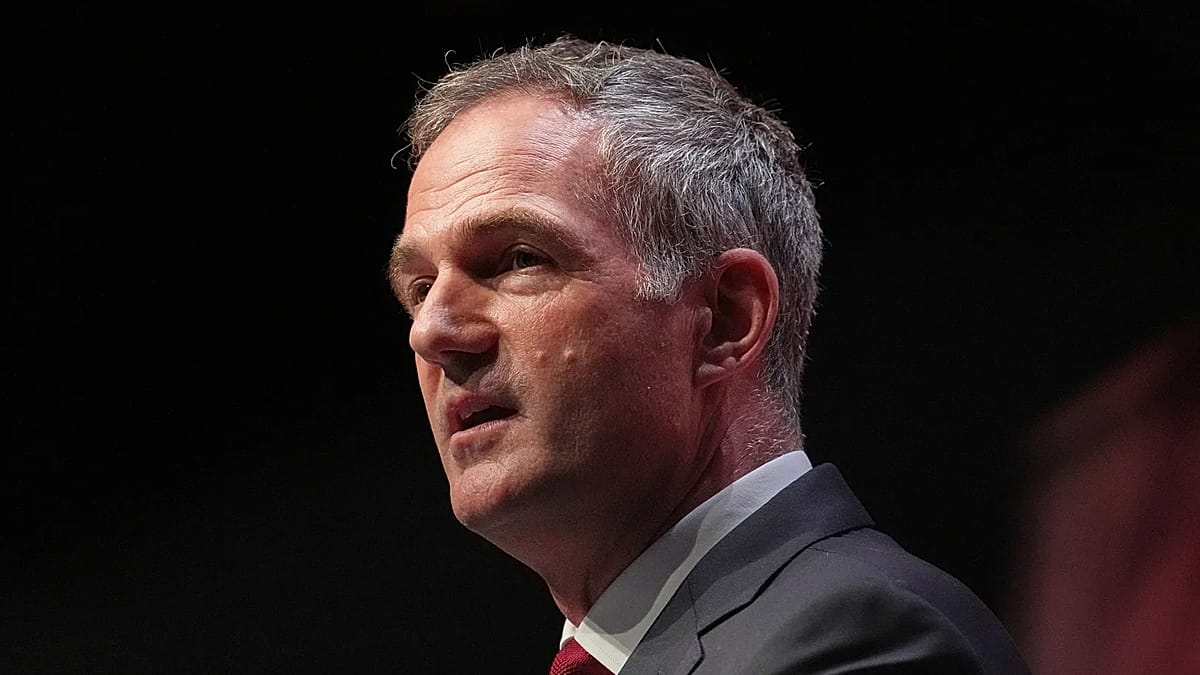

Chief executive Mark Wilkshire said it “affirms our commitment to competitive interest rates”.